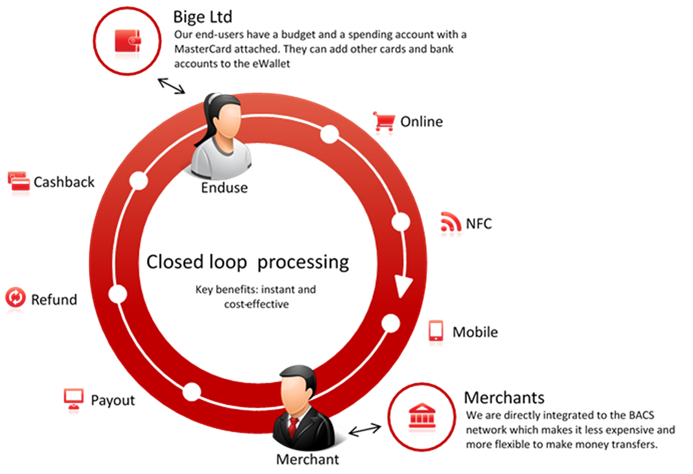

Bige Closed loop processing

When the Merchants/partner is integrated with our platform, and the payment is made with the wallet, the money is taken from the customer, the Merchant/partner receive the payment. Closed loop payment can be available for all Internet and mobile payments.

A closed loop indicates that there are interactions between 2 or more internal elements without interference from the outside. In the financial sector it’s often related to money transfers between accounts in the same financial institute. In the BigeFinancials case, then when issuing virtual accounts to both the merchant and the end-user, it is considered closed loop processing, as the transactions stays in the same closed network.

When the end-user uses the eWallet account the transaction will be routed directly to the Bige platform and the transaction will be cleared and settled directly and instantly. The traditional payment network and card-schemes are not involved and the settlements can be performed instantly. Closed loop payments can be available for all Internet and mobile payments as well as NFC payments.